Challenges in Forecasting Long-term Energy Demand in California

Daniel Nelli

Just as you might plan how to advance in your career, train for a big race, or save money for a trip, forecasting energy demand allows governments, utilities, and other businesses to plan for future energy needs. Such forecasting paints a valuable view of the future, even if not exactly a perfect view — the common sentiment of “All forecasts are wrong, some are useful” comes to mind. Energy forecasting’s value comes in the form of, for example, integrated supply-side resource planning, interconnection planning, and load management planning, each of which has downstream impacts on the cost and availability of energy.

That said, energy forecasting is difficult, particularly in California. Historically, California’s energy demand has been significantly impacted by year-to-year weather variations, climate change, and the growth of energy efficiency and distributed generation (namely, rooftop solar). In addition, new variables are complicating the picture: the proliferation of electric vehicles (EVs), building electrification, demand flexibility, data centers, industrial electrification, and green hydrogen. Our approach to planning must evolve to address these challenges.

Electrification

Let’s start with electrification, namely of vehicles and buildings. Electric vehicle and heat pump technologies have been progressing rapidly in terms of quality, efficiency, and cost. However, the long-term impact of these technologies is uncertain. First, the technologies themselves are uncertain. For example, there are multiple technologies competing for the market (e.g., plug-in electric vehicles vs. fuel-cell electric vehicles, heat pumps vs. electric resistance heaters) — each with different energy implications — and potential future efficiency improvements could change per-unit electricity consumption. On the market side, the supply of rare materials could limit new technology production, consumer concerns surrounding the technologies could impact demand (e.g., EV driving range or EV and heat pump operation in very cold weather), and inflation could dampen customers’ interest in investing in new technologies. Additionally, there are interesting questions regarding the interaction of certain distributed energy resources (DERs). Will rooftop solar systems be larger in the future than they have been historically in order to account for increased vehicle and building demand? Or will customers choose smaller systems as a consequence of the new Net Billing Tariff export compensation structure?

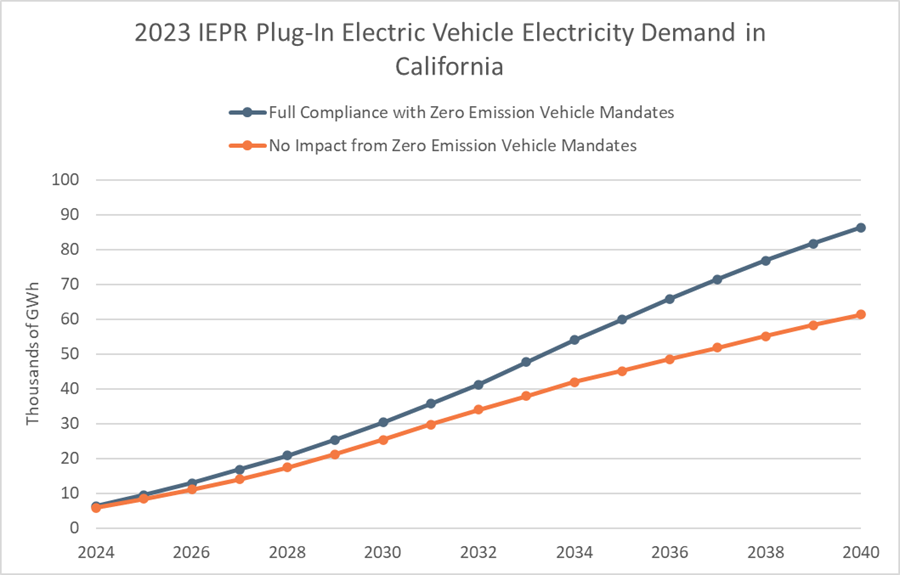

While technological and market factors like these introduce difficulties in forecasting the impact of DERs, the impact of policy mandates should not be overlooked. To illustrate this, note below the difference in electricity consumption of California’s plug-in EVs in two different scenarios of the California Energy Commission’s 2023 Integrated Energy Policy Report demand forecast (Figure 1). Full compliance of EV adoption–related state regulations is assumed in the high scenario but not in the low scenario. The 2040 difference of 25,000 GWh represents 7% of California’s forecasted 2040 annual electricity sales. That’s a significant chunk of system sales that are reliant on EV policy!

Figure 1: California Energy Commission’s 2023 Integrated Energy Policy Report, California Plug-In EV Electricity Demand: full compliance with (Additional Achievable Transportation Electrification scenario 3) vs. no impact from (EV baseline scenario) zero-emission vehicle mandates.

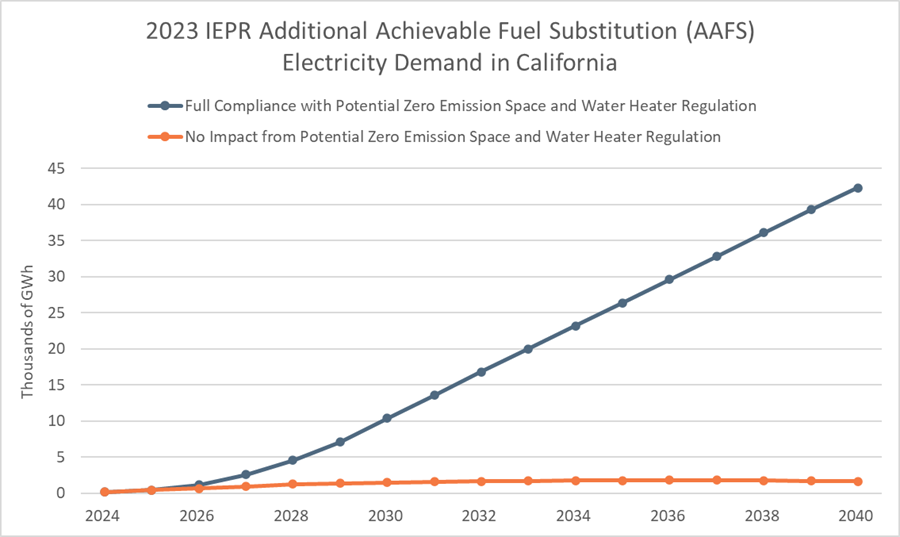

Similarly, Figure 2 below shows the difference in demand in the California Energy Commission’s 2023 Integrated Energy Policy Report scenarios of building electrification (namely, substituting gas appliances with electric appliances in residential and commercial buildings). Again, the difference between the two scenarios — representing the impact of potential zero-emission space and water heater regulation — is significant: 39,000 GWh or 11% of California’s forecasted 2040 annual electricity sales. The uncertainty here is particularly salient as the zero-emission space and water heater regulation assumed in the high scenario has not even been finalized.

Figure 2: California Energy Commission’s 2023 Integrated Energy Policy Report, California AAFS Electricity Demand: full compliance with (programmatic & zero-emission standard components of AAFS scenario 3) vs. no impact from (only programmatic component of AAFS scenario 3) potential zero-emission space and water heater regulation.

Demand Flexibility

While there is uncertainty around DER adoption and energy use on a relatively long time scale, the debate gets more interesting when we zoom in on an hourly time scale, highlighting how customers use their DERs and how flexible their use is.

The usage of certain DERs is reliant on the price of electricity. Batteries often fall into this category: whether and how much they are charging or discharging can vary hour by hour as the battery is operated to maximize revenue. While not all battery use will be responsive to electricity price — some degree of battery energy will be reserved for reliability/backup purposes, and some customers may not receive time-varying price signals — uncertainty of the future price of electricity represents a challenge to forecasting the impact of batteries.

Now, what are EVs if not a big battery on wheels? Beyond simply managing EV charging (for example, via time-of-use electricity rates, demand charges, or aggregator control), there is a growing industry interest in customers being able to use their EV battery like they would a stationary battery at their home or business. That is, an EV could actually discharge some portion of its battery to power the needs of a building or simply to the grid (sometimes dubbed “vehicle-to-everything” or V2X). Like for stationary batteries, electricity price and access to markets represent uncertainties for V2X. Reliability takes on a slightly different meaning here as EV customers rely on being able to drive when needed, not restricted by their vehicle’s participation in an electricity market. But from the perspective of controlling an EV’s participation in a market, an electricity aggregator (for example) relies on an EV being available to plug in and participate in the market when needed, and not be out driving. The challenge of understanding how an EV can or cannot both drive and participate in the market represents a significant barrier to modeling the growth of V2X.

Data Centers

The newest challenge in electric load forecasting is large industrial loads, with data centers being the topic du jour. Data centers are not a new technology, but the data centers of today look very different than their predecessors. Despite data center energy consumption being reasonably flat as of late, there is significant buzz regarding potential growth in this load, especially in light of artificial intelligence and large language model programs like ChatGPT. There are a number of unknowns that will dictate the magnitude of growth. While the demand for new and expanded data centers may seem to be a certainty, the ability to interconnect data centers in a timely manner depends on the capacity of the physical infrastructure of the electricity grid and the potential to upgrade that infrastructure. After the data centers are interconnected, there are questions of how rapidly the load will materialize and how efficient the data centers of the future will be. Their efficiency has improved considerably since 2007 but stagnated in the last 5 to 10 years, and AI may throw a wrench in historical trends. And data centers’ future energy use is unclear: how often will the data centers operate at maximum capacity, what will they do at system peak demand and could that be managed, and will they use behind-the-meter generation to manage their grid electricity need? All of these variables impact the energy that a data center will demand and have significant uncertainty bands.

———

There is no shortage of challenges to long-term energy forecasting; between technology, market, policy, and use variables of DERs in addition to new industrial end uses, forecasters have their work cut out for them. A better understanding of these uncertainties will come from interaction with experts from each sector of the energy industry, and PG&E is interested in such collaborations to better our forecasting, planning, and service to our customers.

Daniel Nelli

Emerging Load Forecasting Analyst

Pacific Gas and Electric

Leave a Reply